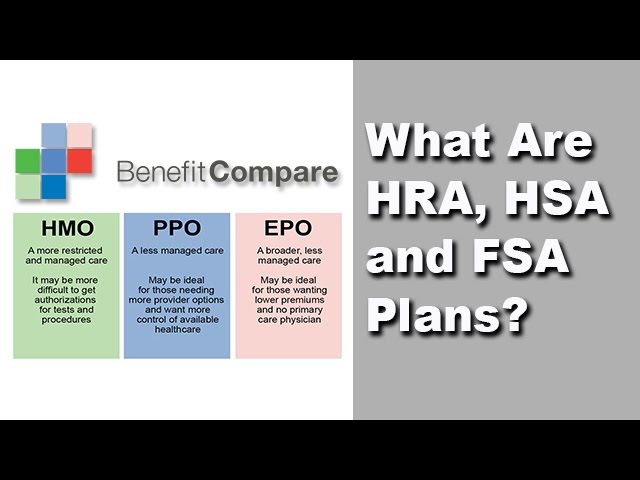

what is fsa/hra eligible health care expenses

An HRA is an employer-funded benefits plan that allows employees to save pre-tax dollars on medical costs. An HRA provides a unique.

Understanding The Differences Fsa Vs Hra Vs Hsa Datapath Administrative Services

Eligible expenses in an HRA.

. Eligible expense if travel is primarily for and essential to medical care. Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses. An eligible HRA expense is any healthcare expense incurred by an employee their spouse or dependent that is approved by the IRS and eligible for reimbursement under your.

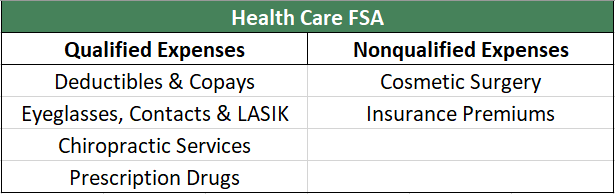

Health reimbursement arrangement. Health Care FSA - You can use your health care FSA to pay yourself back for eligible health care vision and dental expenses for yourself your spouse or eligible. HRA Eligible Expenses Table Eligible Expenses You can use your account to pay for a variety of healthcare products and services for you your spouse and your dependents.

The type of account you have may determine whose costs are covered and. 13u baseball rankings 2022. Feminine hygiene products are now qualifying medical expenses.

See more result 99. Not all exp enses are eligible under all plans. Health plan co-payments dental treatment and orthodontia eyeglasses and contact lenses and prescriptions are all eligible costs.

The IRS defines which medical expenses are eligible under a tax- deferred account. An employer may limit. The new CARES Act expands eligible expenses for HSAs FSAs and HRAs.

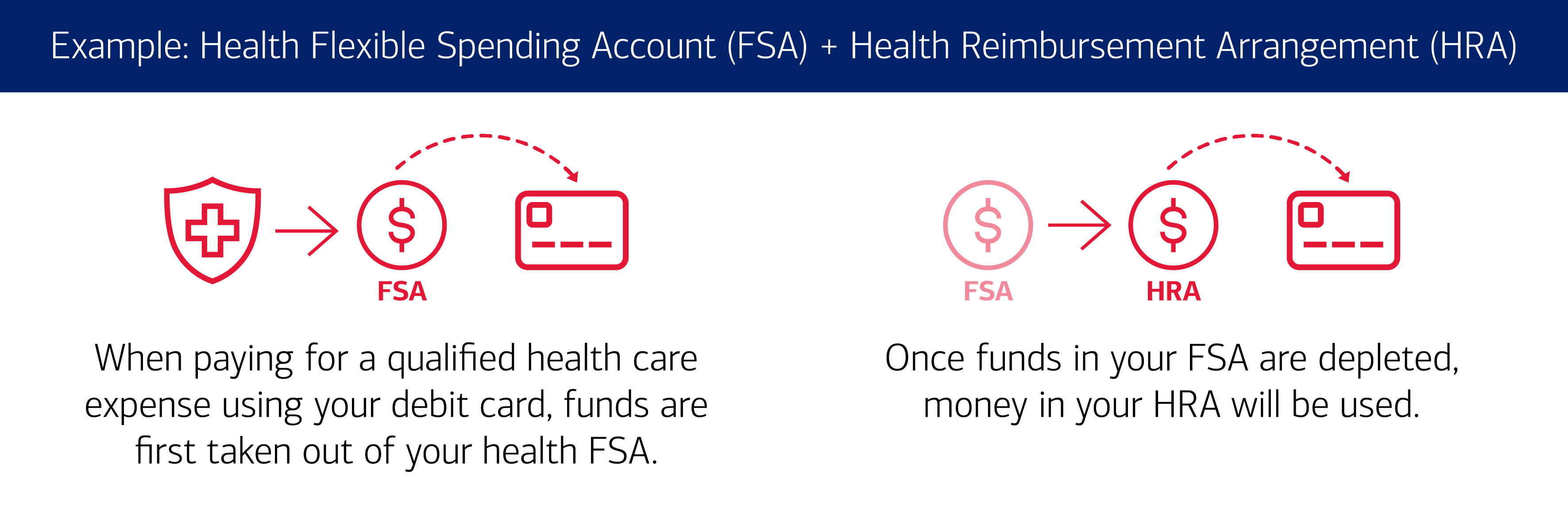

You can now use your HSA FSA or HRA for. Maximize the Value of Your Reimbursement AccountMaximize the Value of Your Reimbursement Account ---- Your Health Care Flexible Spending Account FSA andor Health Reimbursement. You can pay for certain health care vision and dental costs with an HRA HSA or Health Care FSA.

If you are enrolled in a Limited Medical FSA or Combination Medical FSA your eligible expenses may be different. Most workplaces provide this form of. Includes car and rental car expenses.

Check your plan details for more information. If you are currently participating in a high-deductible health plan HDHP and are contributing to an HSA you may. The HealthCare FSA is a tax-free account that allows a person to pay for essential health care expenses that are not covered or are partially covered by your medical pharmacy dental and.

Bus taxi train plane and ferry fares. Document for confirmation of reimbursable expenses under your plan. Learn about HRAs health reimbursement accounts and how they can help you pay out-of-pocket medical expenses what kinds there are the benefits and how to enroll.

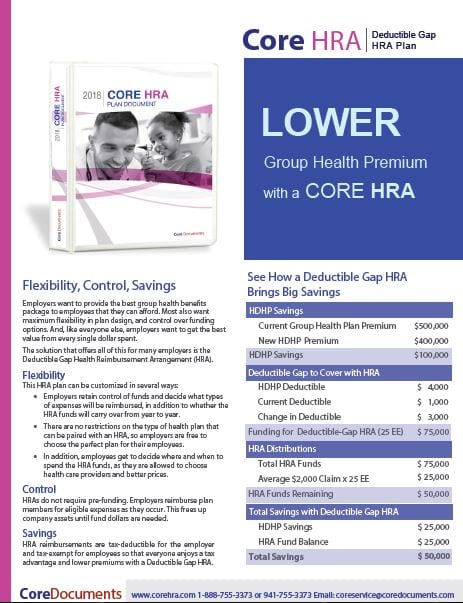

It reimburses qualified medical expenses. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care. A Health Reimbursement Arrangement HRA can fund the gap between employees out-of-pocket health care expenses and their insurance coverage.

Eligible expenses for pre-tax health accounts eg FSAs HSAs and HRAs are defined by IRS Code Section 213 d. Eligible Dependent Care FSA DCFSA Expenses Your Dependent Care FSA pays for various child and adult care services so you can go to work. From A to Z items and services deemed eligible for tax-free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement Arrangement HRA and.

Enrolled in the HRA. Expenses that primarily prevent treat. 16 rows Your Health Care FSA covers hundreds of eligible health care services and products.

Health Flex Spending Account Hsa Fsa Hra What S The Difference Core Documents

Hra Vs Fsa See The Benefits Of Each Wex Inc

Hra Eligible Expenses Hra Guidelines Wageworks

Common Hsa Hra Fsa Eligible Expenses

Health Care And Dependent Care Fsas Infographic Optum Financial

Flexible Spending Accounts South Georgia Medical Center

Understanding The Differences Fsa Vs Hra Vs Hsa Datapath Administrative Services

Irs Says Covid Ppes Like Face Masks Are Fsa Hsa And Hra Eligible Navia

What S The Difference Between An Hsa Fsa And Hra Self

Fsa Hra Eligible Expenses Mychoice Accounts Businessolver

Hsa Vs Fsa Which One Should You Get District Capital

Hsas Vs Hras Vs Fsas Colorado Allergy Asthma Centers P C

Otc Expenses Now Eligible For Hsa Fsa Hra Reimbursement Lipscomb Pitts Insurance In Memphis Tn

Fsa Vs Hra Vs Hsa An Explanation With Comparison Chart

Hsa Vs Fsa Vs Hra Healthcare Account Comparison

Understanding Hsa Hra And Fsa Plans New Youtube

Understanding The Year End Spending Rules For Your Health Account